- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Recently, the global shipping industry has faced significant changes again. Danish Maersk Line and French CMA CGMMaritime TransportationGroup have both announced major decisions that not only affect their operations but also have notable impacts on the global freight market.

Maersk Line announced the suspension of all vessel transits through the Red Sea and Gulf of Aden, a decision made after its vessel Maersk Hangzhou was attacked twice in the Bab el-Mandeb Strait. This incident has heightened uncertainty along the critical Asia-Europe shipping route and raised industry concerns about security in the region.

Meanwhile, CMA CGM announced significant increases in freight rates from Asia to the Mediterranean. Effective from January 15, 2024, the rate for a 40-foot standard container will double from $3,000 to $6,000. This rate adjustment affects regions including the Western Mediterranean, Eastern Mediterranean, Adriatic Sea, Black Sea, and Syria.

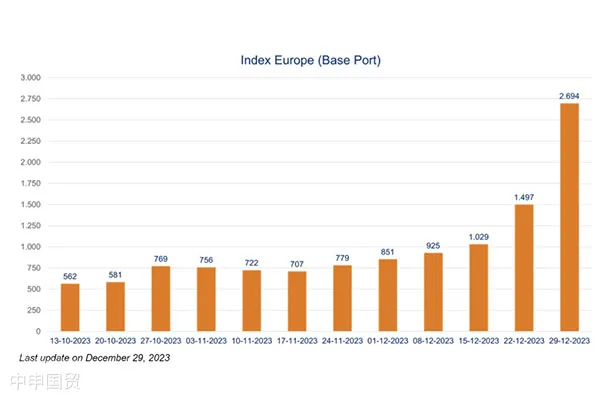

In the Shanghai Containerized Freight Index (SCFI) by global logistics company DSV, freight rates from Shanghai to Europe have risen significantly. In the last weeks of last year, the rate for a 20-foot standard container increased from over $1,000 to nearly $2,700. CMA CGMs latest quote on Tuesday showed that the rate for a 20-foot container from Asia to the Western Mediterranean has reached $3,500.

Maersks suspension of sailings and CMA CGMs freight rate increases reflect the instability in the shipping market. The Red Sea is one of the worlds busiest waterways, and the Bab el-Mandeb Strait is a vital passage connecting the Red Sea and the Gulf of Aden. Several international shipping companies have chosen to suspend or reroute their vessels due to safety concerns, which has significantly impacted global trade flows and freight rates.

Furthermore, the closure of the Suez Canal will force shipowners to either queue for passage through the Panama Canal or detour via the Cape of Good Hope, thereby reducing the efficiency of capacity turnover. The Wall Street Journal reported that Maersk expects its full-year 2023 profits to be at the lower end of its target range while planning to lay off over 10,000 employees. CNBC pointed out that the shipping industry will continue to face a challenging economic environment in 2024.

Related Recommendations

Contact Form

? 2025. All Rights Reserved. 滬ICP備2023007705號-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912