- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

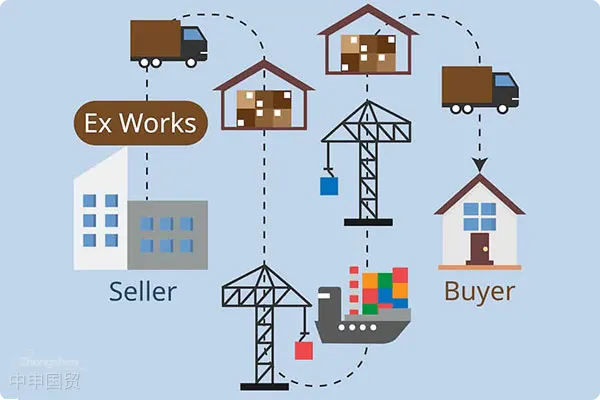

In international trade, EXW (Ex Works) is a commonly used trade term that clearly defines the responsibilities and cost allocations between buyers and sellers during delivery. However, have you ever had disputes with clients over warehouse entry fees? Under EXW terms, the seller only needs to deliver goods at the factory, but when clients request additional services, the division of responsibilities and costs becomes less straightforward! Today, we will reveal the boundaries of responsibility under EXW terms and share strategies to help you avoid unnecessary risks and losses.

Based on the definition and characteristics of EXW terms, lets analyze whether warehouse entry fees should be charged.

Basic Definition of EXW Terms

- Sellers Responsibilities:

- Prepare the goods at the designated location (usually the sellers factory or warehouse) and notify the buyer for pickup.

- Once the goods are loaded or leave the factory gate, the risk and responsibility transfer to the buyer, and the seller is no longer responsible for any transportation, loading/unloading costs, or risks.

- Assist the buyer in preparingExport Clearancerequired documents but are not responsible for specific operations or payment of fees.

- Buyers Responsibilities:

- The buyer bears all costs and risks after the goods are loaded at the sellers factory or warehouse, including loading fees, transportation fees, customs clearance fees, port charges, and warehouse entry fees.

- The buyer must arrange logistics (or delegate to a freight forwarder) to pick up the goods from the sellers factory and pay all costs from the pickup location to the destination.

Definition of Warehouse Entry Fees and Responsibility Allocation Under EXW Terms

- Warehouse Entry Fee: Warehouse entry fees typically refer to costs incurred when goods enter a warehouse or storage yard, such as loading/unloading fees, warehousing fees, and tallying fees. These fees generally occur when goods are transported from the factory to a designated warehouse, container yard, or port storage area.

- Responsibility Allocation for Warehouse Entry Fees Under EXW Terms: Under EXW terms, the sellers responsibility is limited to delivering goods at their factory, while all subsequent transportation, loading/unloading, and warehouse entry fees are borne by the buyer. Therefore, the seller does not need to pay any fees incurred after the goods leave the factory, including warehouse entry fees. If the buyer requests the seller to deliver goods to a designated warehouse, this process constitutes an additional service beyond EXW terms, which usually requires separate negotiation and agreement, with the buyer paying the corresponding additional fees (e.g., transportation fees, warehouse entry fees).

Handling Client Requests for Delivery to Designated Warehouses Under EXW Terms

In practice, even if the contract terms are EXW, clients may sometimes request sellers to deliver goods to a designated warehouse for various reasons (e.g., logistics arrangements, warehouse locations). In such cases, sellers can adopt the following approaches:

- Clarify responsibility allocationConfirm with the customer or their freight forwarding company, emphasizing that the current contract terms are EXW, and the seller is not responsible for any costs after the goods leave the factory. If the customer requires the seller to assist with delivery to a designated warehouse, the buyer shall bear the additional transportation costs and warehousing fees, which shall be paid upon mutual agreement.

- Agency transportation servicesIf the customer wishes the seller to assist with transportation arrangements, agency services can be provided based on actual circumstances, and the customer should be informed in advance of any additional costs (such as freight, warehousing fees, loading/unloading fees, etc.). The seller may pass these costs on to the customer or have them paid by the customers freight forwarding company.

- Written confirmation agreementIf the seller agrees to deliver the goods to a designated warehouse, it is recommended to confirm the responsibilities and cost allocation between both parties in advance through a written agreement (such as email, additional clauses, etc.) to avoid subsequent disputes.

Case Study: Disputes Over Warehouse Entry Fees Under EXW Terms

Case Background:

- Contract terms: EXW (Ex Works).

- Customer request: Deliver the goods from the factory to the customers designated warehouse and expect the seller to cover the warehousing fees.

Handling method:

- The seller should first inform the customer that under EXW terms, the sellers responsibility is limited to delivery at the factory, and all costs and risks after the goods leave the factory are borne by the buyer.

- If the customer insists on the seller arranging transportation and warehousing, additional transportation and warehousing fees can be negotiated with the customer, and the cost allocation should be clearly stated in a written agreement.

- On this basis, the customer can arrange for their own freight forwarder or logistics company to pick up the goods and deliver them to the designated warehouse, avoiding direct seller involvement in subsequent transportation.

V. Summary

Under EXW terms, the sellers responsibility is very limited, and all transportation and handling costs outside the factory, including warehousing fees, are borne by the buyer. Therefore, when the customer requests delivery to a designated warehouse and involves warehousing fees, the seller should adhere to the contract terms, clearly informing the customer that the warehousing fees are the buyers responsibility or charging additional fees based on negotiation. This ensures clear responsibilities and avoids unnecessary costs and disputes.

: For goods exported to Thailand, the value - added tax rate isIn practice, all operational details should be confirmed in advance with the customer and freight forwarding company, and the relevant responsibilities and cost allocations should be documented in writing to protect the sellers interests.

Related Recommendations

? 2025. All Rights Reserved. 滬ICP備2023007705號(hào)-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912