- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

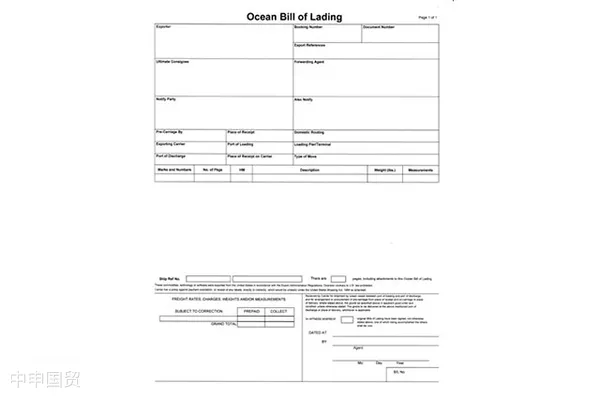

In international trade, the choice of payment method often determines the success of a transaction. When considering whether to accept a clients request for 100% payment against copy of bill of lading, its crucial to carefully assess potential risks. This payment method typically means the seller wont receive payment until providing the bill of lading copy. For sellers, this represents a relatively high-risk transaction as once goods are shipped, buyer default could lead to cargo detention, additional costs, and potential disposal issues. This article reveals the hidden risks of this payment method and provides effective operational strategies to protect interests while facilitating smooth transactions.

Analysis of 100% Payment Against Copy of Bill of Lading

I. Risk Analysis

(1) Issues of cargo control:After handing the bill of lading copy to the buyer, the buyer theoretically gains the right to take delivery. If the buyer doesnt pay, it becomes very difficult for the seller to reclaim the goods.

(2) Payment risks:If the buyer defaults after receiving the bill of lading copy, the seller may face unrecoverable payment risks.

(3) Legal risks:In cross-border transactions, limitations in legal enforceability may make debt recovery or cargo retrieval complex and costly.

II. Recommended Operational Strategies

(1) Credit evaluation:Before accepting such payment terms, conduct thorough evaluation of the buyers credit background. Obtain the buyers trade history and credit reports if possible.

(2) Down payment:Consider requiring partial advance payment (e.g., 30%) as a deposit to mitigate risks.

(3) Credit insurance:Consider purchasing credit insurance for the transaction to reduce risks from buyer non-performance.

(4) UsageL/C:Consider using bank letters of credit as payment method to provide payment security at the banking level.

(5) Legal consultation:Before formally signing the contract, it is advisable to consult legal counsel to clarify contract terms and ensure sufficient legal protection in case of buyer default.

III. Transaction Execution

(1) Bilateral negotiation:Engage in in-depth communication with the buyer to clarify detailed terms for delivery and payment, striving to secure safer payment methods such as advance payment or letters of credit (L/C).

(2) Rigorous legal clauses:The contract should include clear provisions for risk allocation, liability for breach of contract, and dispute resolution mechanisms.

Through this risk analysis and professional advice, we hope to provide wiser handling of 100% payment against copy of bill of lading transactions. Accepting such payment terms carries significant risks without adequate credit guarantees and legal protections. We recommend taking appropriate preventive measures to protect your interests or seeking safer settlement methods such as letters of credit.

Related Recommendations

Learn

Contact Us

Email: service@sh-zhongshen.com

Related Recommendations

Contact via WeChat

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912