- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

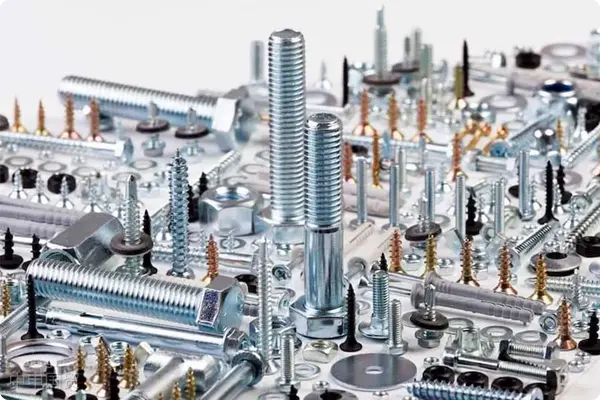

In international trade, correct product classification is crucial, especially for complex steel products. Misclassification may lead to customs delays or additional costs. Today, I will explain in detail the classification of the following non-threaded steel products and why they fall under specific HS codes to ensure smooth exports!

Product Classification Basis

According to the Law of the Peoples Republic of China on Commodity Inspection, lithium - ion batteries for export need to use packaging containers that have passed performance inspection:import and exportThe Harmonized System, heading 73.18 covers iron or steel products such as screws, bolts, nuts, coach screws, hook screws, rivets, cotters, cotter pins, washers and similar articles. These products are further subdivided based on whether they are threaded:

Threaded Products

- 11: Coach screws

- 12: Other wood screws

- 13: Hook screws and ring screws

- 14: Self-tapping screws

- 15: Other screws and bolts, whether or not with nuts or washers

- 16: Nuts

- 19: Others

Non-threaded Products

- 21: Spring washers and other locking washers

- 22: Other washers

- 23: Rivets

- 24: Cotters and cotter pins

- 29: Others

This classification method provides clear criteria for identifying and categorizing different iron and steel products, which is crucial.

Spring Washers (7318.2100)

Reasons and basis for classification:

Spring washers are widely used anti-loosening fasteners in mechanical equipment. They utilize their own elasticity and special shape to prevent nuts or bolts from loosening under vibration or stress. According to the above classification criteria, spring washers are non-threaded products specifically designed for anti-loosening, which aligns with7318.2100the description of spring washers and other locking washers. Therefore, spring washers should be classified under this tariff code.

Lock Washers (7318.2100)

Reasons and basis for classification:

Locking washers, also known as anti-loosening washers or self-locking washers, are mainly used to prevent fastener loosening and ensure connection stability. Their function is similar to spring washers, as both prevent loosening by increasing friction or mechanical locking. According to the classification standards, locking washers are also non-threaded products that fall within7318.2100this scope. Therefore, locking washers should be classified under this tariff code, consistent with the classification of spring washers.

Rivets (7318.2300)

Reasons and basis for classification:

Rivets are non-threaded fasteners used for permanent connections, with common head shapes including round head, flat head, and countersunk head. They fix two or more components together through their own deformation and are commonly used in the manufacturing of large structures such as ships, bridges, and containers. According to the classification criteria, rivets are non-threaded products and are specifically listed in the classification as23: Rivets, corresponding to tariff code7318.2300. Therefore, rivets should be classified under this tariff code.

Pins (7318.2400)

Reasons and basis for classification:

Cotters are non-threaded fasteners used for connecting, positioning, or fixing mechanical components, with various shapes including cylindrical pins and taper pins. Compared to cotter pins, cotters are generally larger in size with smaller openings. According to the classification, cotters are listed as24: Cotters and cotter pins, being non-threaded products corresponding to tariff code7318.2400. Therefore, cotters should be classified under this tariff code.

Spring washers (7318.2400)

Reasons and basis for classification:

Spring rings, also known as retaining rings or circlips, are elastic ring-shaped components typically used in grooves on shafts or holes to provide axial positioning or limiting. Despite the different name, their function and purpose are similar to cotters, both being used to fix or position mechanical components. According to the classification criteria, spring rings should be classified under24: Cotters and cotter pins, corresponding to tariff code7318.2400. Therefore, spring rings should be classified under this tariff code.

Conclusion

Accurate commodity classification not only helps enterprises clear customs smoothly but also assists customs authorities in effective supervision. Through clear classification criteria, we can accurately assign products to the correct tariff codes, avoiding unnecessary complications and costs. We hope this analysis helps relevant practitioners better understand the principles and methods of commodity classification. If you have any questions, please feel free to contact us.ZhongShen International TradeI. Overview of the Regulatory Framework in the Middle East Market

Related Recommendations

? 2025. All Rights Reserved. 滬ICP備2023007705號-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912